💡 A Platform Built for Everyone, Yet Not Working for Many

As the team’s product designer, I sat down on a monday staring at the dashboard. The numbers were merciless.

🔻 KYC completion rate: 41%

🛟 First-time deposit success: 18%

🗿 Bank addition completion rate: 25%

📉 User trust sentiment: very low

📈 Onboarding drop-off: painfully high

Meanwhile, the Indian crypto market was heating up. Competitors like Binance and Bybit were pushing fast KYC funnels. Yet here we were—an India specific exchange boasting institutional-grade derivatives, but losing retail traders in the first ten minutes, We were lacking something crucial yet fundamental.

A 24-year-old beginner trader, captured the sentiment perfectly in his feedback:

❝ Bhai, I was ready to trade. But your KYC is too long, bank addition is confusing, and I honestly didn’t know what step comes next. ❞

A professional options trader, echoed a deeper frustration:

❝ I don’t need hand-holding, I need speed. Your onboarding makes me feel stuck. ❞

I knew that until & unless onboarding was fixed, nothing else mattered—no product update, no new futures or options contract, no marketing campaign.

This case study is the story of how we rebuilt onboarding from scratch—shorter, clearer, compliant, trustworthy, and conversion-focused.

⚜️ THE PROBLEM LANDSCAPE

🎯 Problem 1 — High Dropout & Low Conversion

All problems pointed to one outcome: Users abandoned onboarding before completing even step 2.

This was costing:

New signups

Brand reputation

First-time deposits

Growth momentum

Daily-trading volume

It was clear: 👎 Onboarding was a business bottleneck.

✨ Solution 1 — Fluid Signup and onboarding process

Along with Email sign-in/signup we also Integrated Google Identity Services (GIS) sign-in/signup feature ("Sign in with Google" or "One Tap") for a secure and streamlined onboarding

🎯 Problem 2 — No Progress Indicator after onboarding. Users Felt Lost.

Earlier, the onboarding flow relied solely on CTA text:

But there was no progress tracking UI, no visual milestone, no sense of “how far I’ve come.” Users felt like they were falling into a never-ending funnel.

Symptoms:

😵💫 Confusion

🪜 Perception of “long process”

🫠 Anxiety about compliance

🐾 Higher drop-offs at each micro-step

Even Aman expressed: “If I knew I’m 50% done, I’d continue. But it felt like there’s more and more.”

✨ Solution 2 — Introducing a 3-Step Visual Progress Indicator We redesigned the entire home screen for new users.

The indicator included:

Complete KYC

Add bank details

Add funds

Each step lit up as users progressed.

Why this worked:

Clear expectation → reduced anxiety

Psychological momentum → higher completion

Visual progress → increased motivation

This alone reduced drop-offs by ~19% in the first week.

🎯 Problem 3 — Tedious KYC, Bank Addition & Deposit Flows

The UX audit exposed the brutal truths:

KYC issues:

⽥ Too many fields upfront

🫥 No real-time validation

🏋 Heavy document uploading

⏳ Manual approval delays

🆘 OCR failures

Bank addition issues:

Users needed to enter account numbers manually

Any mismatch meant a complete restart

Verification took time

No penny-drop automation

Adding funds issues:

No UPI integration

Clumsy UI

Only bank transfers

Users dropped out when asked to switch apps

Industry benchmark: 85% of Indian retail traders prefer UPI for deposits under ₹10,000. We weren’t supporting the #1 behaviour of the market.

✨ Solution 3a — Fully Optimised & Shortened KYC Flow KYC went through an entire structural overhaul.

Key Improvements:

A. Smart Auto-Fill PAN & Aadhaar data auto-filled via digilocker APIs.

B. Real-Time Validation

Name mismatch

Address mismatch

Document clarity

Face match & liveness

C. 60% fewer fields only show necessary input at each micro-step.

D. Automated Liveness Check AI-powered “blink and rotate” liveness allowed frictionless identity verification.

Result: KYC completion time reduced from 4.5 minutes → 1.3 minutes.

✨ Solution 3b — Bank Addition Optimised with Penny Drop & Reverse Penny Drop what used to happen:

Users manually typed: account number → IFSC → name → bank branch → confirm. A nightmare.

What happens now:

User enters account number → We penny-drop ₹1 → bank confirms

Name

IFSC

Branch

OR

Reverse penny drop → Users make a UPI payment to Delta's bank accounts → We fetch Bank Account Number, IFSC, UPI ID, User Name → We reverse the payment made to user’s account.

UX Improvements:

Zero manual entry

No document upload

No retry loops

95% auto-verification success

Result: Bank addition completion increased by 34%.

✨ Solution 3c — UPI-Based Instant Deposit Flow

We integrated:

UPI Payment

Bank Transfers

UPI Limit - Up to 1L

Bank Transfer - No Limit

UX Enhancements:

Minimal taps

Retry mechanism for failures

Auto-fill amount presets

Real-time success callback

Secure VPA mapping for fraud protection

Result:

First-time deposit success soared to 67%

Overall FTD (First-Time Deposit) conversion up by 52%

🎯 Problem 4 — Low Trust, High Anxiety

Crypto + India = A market where trust is the single biggest currency.

Users were asking:

“Is my data safe?”

“Why so many steps?”

“Is this platform registered with FIU?”

“Is this exchange legit?”

“Why do I have to add my bank first?”

The absence of visible trust markers amplified fear.

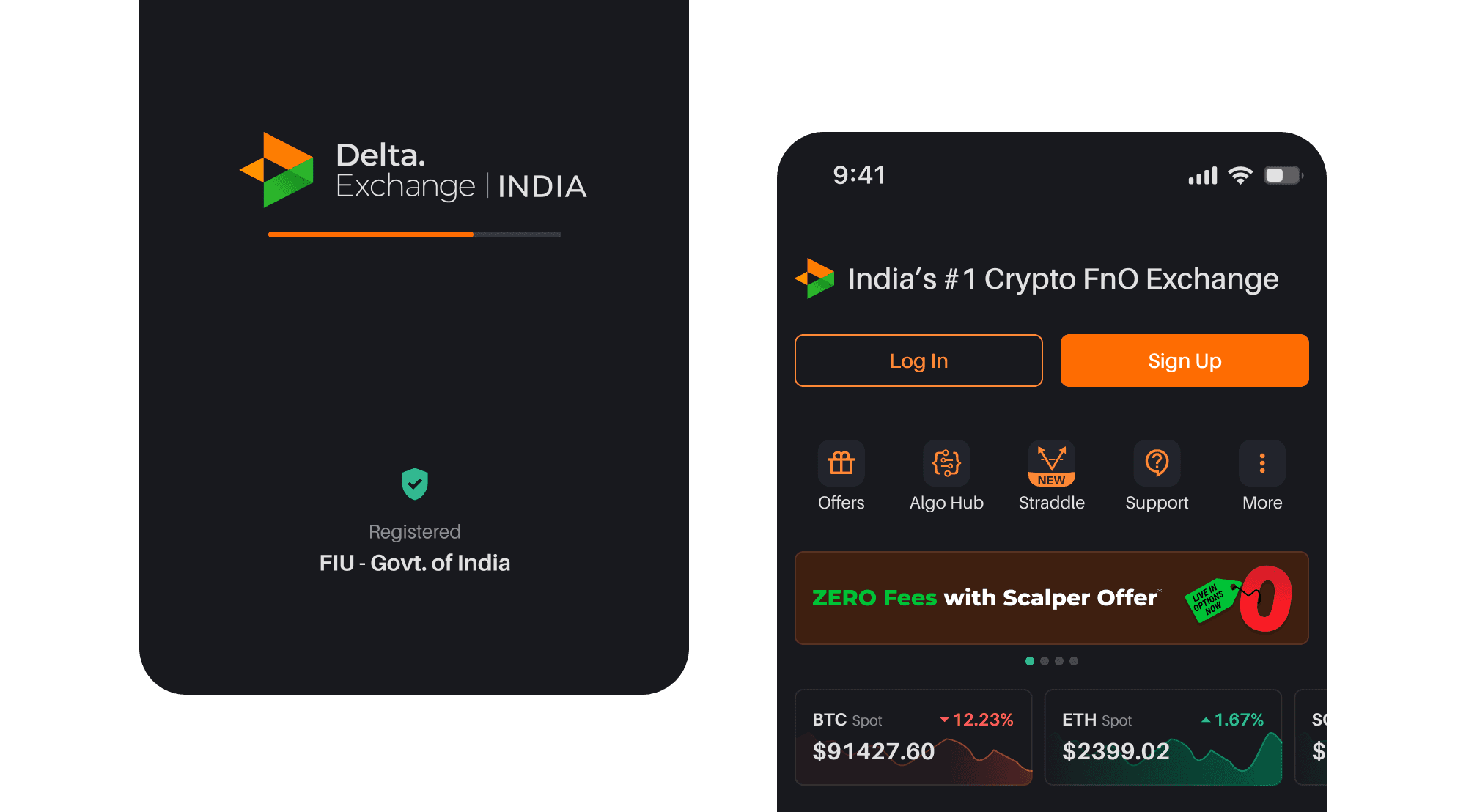

✨ Solution 4 — Trust Layer Added with FIU Registration Highlight Crypto is trust-first.

We strategically added:

FIU-RC Registration Badge

“Bank account used only for withdrawals” statement

“Your data is encrypted & never shared” microcopy

RBI/SEBI-compliant language for KYC

Security seals

A user said: “I continued KYC because I saw FIU. Before that I wasn’t sure.”

Trust went from an assumption to a feature.

⚜️ AFTERMATH: IMPACT & MEASURES

The redesign wasn’t cosmetic. It was transformational.

📈 Quantitative Metrics

🚀 KYC completion: 41% → 78%

💰 First deposit success: 18% → 67%

🙌 Day-1 activation: up by 44%

🏦 Bank addition completion: 25% → 59%

📉 Onboarding drop-off: down by 38%

🦋 User trust sentiment: increased by 35%

📌 Business Impacts

⚡️ Faster funnel → more active accounts

🤝 Better onboarding → higher long-term retention

💸 More deposits → higher trading exposure

🇮🇳 FIU trust → higher credibility in India

📌 Experience Impacts

New Users: felt confident & guided

Seasoned Traders : felt speed & efficiency

Design Team : felt clarity in the product story

Compliance Team: felt compliance without friction

⚜️ KEY LEARNINGS

The redesign wasn’t cosmetic. It was transformational.

Progress indicators drastically reduce uncertainty.

Automation is the strongest UX.

Trust-building must start on step 0, not step 5.

Short flows = Higher dopamine = Higher conversions.

India = UPI first. Build for behavior, not assumptions.

Compliance does not need to ruin the experience.

Microcopy is a conversion tool, not decoration.